Expert team

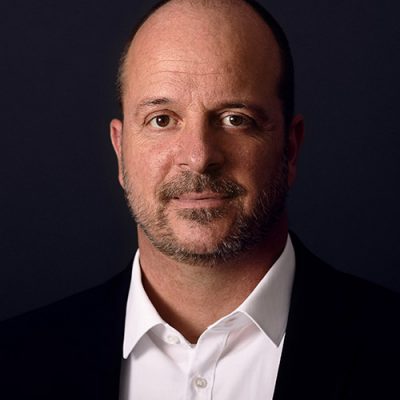

Joachim Hahn

managing director

+49 211 972693-01

- Strategic M&A project management

- Negotiation management

- Strategy development

Joachim Hahn has more than 17 years of experience in structuring, executing and negotiating national and international M&A projects. He has held senior M&A positions at Bayer, E.ON, Bilfinger and DMG MORI. Joachim Hahn has first-hand knowledge of the internal procedures and decision-making processes in large companies. This deep understanding of internal processes and mechanisms and his extensive M&A experience from numerous transactions allow him to offer a consulting concept that is ideally tailored to the client’s needs.

Joachim Hahn has been in charge of national and international corporate acquisitions, divestitures and joint venture projects in Germany, the USA, China, France, Poland, Turkey, Brazil and other countries.

Gary Knott

financial modeling

+49 211 972693-10

- Financial modeling (integrated M&A and strategic models)

- Business valuation

- Data analysis

Gary Knott is a business modeling and Excel expert with more than 25 years of professional experience, many with Deloitte in the UK and Germany. He has developed numerous flexible models for M&A transactions, valuations, strategic planning, project planning/financing, and cash flow planning for clients in a variety of industries. These include large international corporations and mid-sized companies, all of which have benefited from his extensive experience and an approach that is as practical as it is pragmatic.

Sebastian Wiegmann

transaction services

+49 211 972693-11

- Financial due diligence

- Vendor assistance

- Corporate finance

- Accounting advisory

Sebastian Wiegmann has been working in consulting on national and international projects since 2000. After 7 years of transaction consulting with one of the Big Four accounting firms in Düsseldorf and Dublin, he worked for 3 years as an investment manager with an Irish based private equity holding company. Sebastian Wiegmann is a Chartered Certified Accountant and has been working as an independent corporate and transaction advisor since 2011. He advises companies of various sizes and regularly supports renowned consulting and accounting firms on all topics related to financial due diligence, spin-offs, carve-outs and pro forma financials.

Phillip Reinartz

project management

+49 211 972693-16

- M&A project management

- Post merger integration

- Commercial due diligence

- Business planning / financial modeling

Phillip Reinartz has more than 12 years of experience in transaction advisory with a focus on M&A, post-merger integration, coordination of interdisciplinary due diligence projects as well as the execution of commercial due diligence reviews. In his career, Phillip Reinartz has been responsible for a large number of transactions for medium-sized companies, listed groups as well as national and international financial investors (small- and mid-cap). In addition to traditional M&A project management, Mr. Reinartz has extensive experience in commercial due diligence and post merger integration.

Anna Rösch

project management

+49 211 972693-03

- Project management

- M&A research

- Marketing

- Organisation

Anna Rösch holds a bachelor’s degree in media business with a focus on marketing management as well as a master’s degree in market-oriented business management from the Technical University of Cologne.

During her studies, she already gained professional experience in the B2B as well as the B2C sector in the media, fashion and real estate industries, both in the environment of established companies and with start-ups. Since 2018 she has been working for complemus consulting in the areas of project management, M&A research, marketing and organization.

Oskar

compliance officer

- Security

- Employee motivation

- Health management

Oskar graduated from the Higher Dog School with honors and has since worked in the field of personal and facility protection.